Intel: Falling Knife Or Great Opportunity?

Summary

- Compared to its competitors NVIDIA, Texas Instruments or Advanced Micro Devices, Intel underperformed in the last ten years.

- Intel has been reporting mediocre results for several years now, but has a clear strategy towards double-digit revenue growth.

- But even when the strategy is not working out, Intel seems to be at least fairly valued and the stock is at a strong support level.

JasonDoiy/iStock Unreleased via Getty Images

During the last 12 months I published two articles (see here and here) about Intel (NASDAQ:INTC) and in both cases I was bullish about the stock and considered it already undervalued. Nevertheless, the stock continued to fall and following that advice until now would have resulted in a loss and an underperformance of the S&P 500 (SPY).

Right now, Intel is trading close to the cheapest level it has been trading for since 2017. And in such situations, one might be tempted to call Intel a bad investment as the stock price is declining further and further and often, we see analysts switching from "bullish" to "bearish" in such a scenario. However, that's not how investing works (at least not long-term investing). As long as the fundamental assessment of the business wasn't completely wrong, a cheaper stock price is making the company a better investment and should make use more bullish.

In the following article I will check once again if Intel is a solid business from a fundamental perspective and what growth potential we can expect. And based on that analysis we can calculate an intrinsic value and answer the question again if Intel is a great long-term investment or a falling knife.

Pick A Competitor Instead?

When talking about Intel, one might be tempted to just pick a competitor instead. At least when looking at the stock performance during the last ten years, almost every other semiconductor company seemed like a better investment. Intel clearly underperformed companies like Texas Instruments Incorporated (TXN), which increased 684% in the last ten years or Advanced Micro Devices, Inc. (AMD), which increased 1,480%. And NVIDIA Corporation (NVDA) outperformed in an impressive way - 6,340% growth (total return numbers for all four stocks).

Unless you bought Intel before the Dotcom bubble, your investment underperformed the S&P 500 during every major timeframe and Intel was not a great investment in the past few years (or past two decades). Many investors tend to pick those stocks that outperform right now and picking the winners in an industry is certainly a sound investment approach. But investments can't just be made by looking at the stock performance. Right now, it seems like nobody wants to own Intel, but everybody wants to own NVIDIA and AMD.

And while it seems reasonable to pick the winners of an industry, we should be careful not to invest in businesses that are hyped (no matter if we are talking about high growth businesses or not). When stocks are trading for extremely high valuation multiples - and NVIDIA for example is trading for a P/E ratio above 50 - we should be careful. The best investments would be those businesses that are able to grow with a high pace but are trading for a depressed valuation multiple (for whatever reason). Intel is clearly trading for a depressed multiple right now and we must answer the question if that is justified or not.

Quarterly Results

When looking at the last quarterly or annual results, the depressed multiples are probably not completely unjustified. In the first quarter of fiscal 2022, the company once again reported mediocre results with revenue declining from $19,673 million in the same quarter last year to $18,353 million this quarter - a decline of 6.7% year-over-year. While the top line was not great, operating income and the bottom line could improve - mostly due to "restructuring and other charges" that had negatively affected Q1/21. As a result, operating income increased from $3,694 million in Q1/21 to $4,341 million in Q1/22 - 17.5% year-over-year growth. And diluted earnings per share improved from $0.82 to $1.98 - 141% increase.

Intel Q1/22 Presentation

When the results of the last few quarters didn't get you excited about Intel, the guidance for fiscal 2022 will probably have the same effect. In fiscal 2022, Intel is expecting more or less the same revenue as last year (maybe a slight increase) and adjusted earnings per share will be around $3.60 (resulting in 32% lower numbers compared to fiscal 2021). Adjusted free cash flow will even be negative in fiscal 2022 - due to much higher capital expenditures than in the past (about $27 billion this year). As long as Intel is spending money to invest in the future which will result in growth, it is not a problem if Intel is reporting a negative free cash flow in one single year.

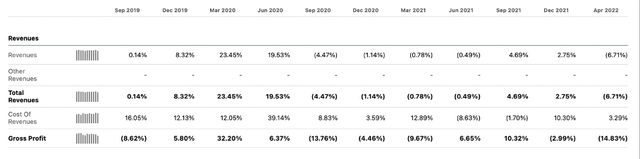

Seeking Alpha

And Intel is not just struggling right now (in the current quarter) but is struggling for quite some time. When looking at the last few quarters, we see rather low revenue growth - aside from a few exceptions - and gross profit is also fluctuating widely.

Accelerate Growth

However, we should not just look at the past results, but also what to expect in the years to come. When looking at analysts' expectations we see earnings per share declining in the next few years before Intel will increase its EPS again.

Seeking Alpha

This is more or less in line with management's expectations and the company's own path to accelerate growth in the years to come. I already mentioned above that Intel is expecting no free cash flow (or maybe even negative free cash flow) in fiscal 2022 due to extremely high capital expenditures ($27 billion - the highest amount ever). In fiscal 2022 (and probably fiscal 2023) Intel will have high capital expenditures as it is in its "investment phase".

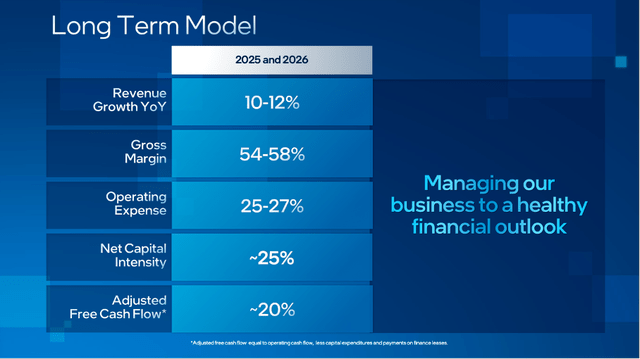

Intel Investor Meeting 2022

According to management, these investments should lead to a double-digit growth in revenue, which is stemming in parts from Intel's traditional business and mostly from the emerging business. When looking at the traditional business, Intel is expecting mid-to-high single digit growth and growth will especially stem from Data Center & AI (mid-to-high single digit growth) as well as Network & Edge (growth in the mid-teens is expected).

The second part of growth should stem from the emerging business, which is including Foundry, Mobileye as well as AXG (Graphics and Accelerated Compute). In fiscal 2021, Mobileye generated almost $1.4 billion in revenue and the company will probably have its IPO in the second half of 2022 and Mobileye, which Intel bought for $15.3 billion in 2017, might be valued as high as $50 billion. Intel will keep a majority stake in Mobileye after the IPO. Mobileye is focused on the development of advanced driver assistance systems and autonomous driving technologies and has BMW, Audi, Volkswagen, Nissan, Honda and General Motors as its clients.

Intel is especially betting on its Foundry business becoming a huge success. The company will invest about €33 billion in R&D over the next few years. In the first quarter of fiscal 2022, Intel Foundry Services generated $283 million in revenue (an increase of 175% compared to the same quarter last year). And finally, AXG (Accelerated Computing Systems and Graphics Group) will contribute to growth as the segment is expected to grow from about $0.7 billion in revenue in fiscal 2021 to about $10 billion in fiscal 2026.

Intel Investor Meeting 2022

In total, management is expecting low growth rates right now but assumes growth to accelerate over the next few years. And from 2026 going forward, management is targeting revenue to grow between 10% and 12% annually.

I must admit that I am lacking the expertise to make a clear and convincing statement if Intel's strategy will work or not. However, Intel's strategy of double-digit growth does not have to work for the stock to be a solid investment as the stock is trading at such depressed valuation levels right now. The stock could be a great investment solely due to the negativity that is surrounding Intel right now.

Intrinsic Value Calculation

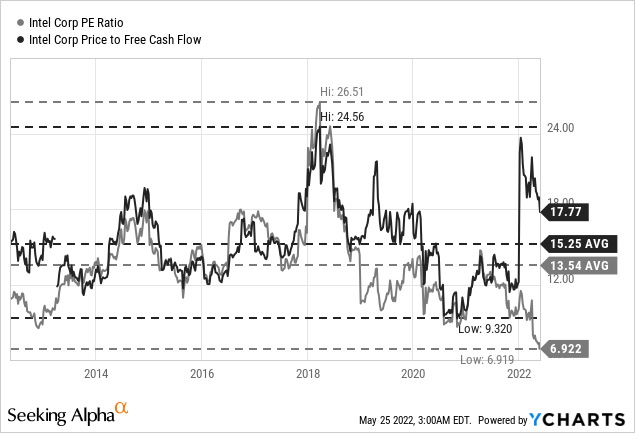

While other semiconductor companies are trading for rather high valuation multiples - NVIDIA is trading for 50 times earnings, AMD is trading for 38 times earnings and Texas Instruments is trading for 20 times earnings (see also section above) - we see Intel trading for a single digit P/E ratio, which is underlining how little confidence investors currently have in Intel.

When looking at the last ten years, Intel was always trading for a rather low P/E ratio (with the average being 13.54). But right now, Intel is trading for the lowest P/E ratio in a long time. Aside from the P/E ratio, we can also look at the price-free-cash-flow ratio (which I consider the better metric) and the picture is a little different. Due to the high capital expenditures of Intel right now, free cash flow is rather low resulting in a P/FCF ratio of around 15. However, this is still below the 10-year average of 18 and when looking at the valuation multiples many other stocks are trading for, Intel does not seem expensive right now.

Additionally, we can also use a discount cash flow calculation to determine an intrinsic value for Intel. And like in previous articles, I will offer three different calculations again - a bull case, a bear case, and a base case scenario. Let's start with our bear case scenario.

Bear Case Scenario

In our bear case scenario, we assume $0 free cash flow in fiscal 2022 as well as fiscal 2023 (due to extremely high capital expenditures). For fiscal 2024, we assume that Intel will return more or less to previous free cash flow levels - about $15 billion. But we assume that the growth initiatives won't work, and Intel will only be able to grow in the low single digits (about 2% growth) till perpetuity. This will lead to an intrinsic value of $37.73 for Intel.

Base Case Scenario

In the base case scenario, we also assume $0 free cash flow in fiscal 2022 and about $5 billion in FCF in fiscal 2023 (management is expecting still high capital expenditures next year). For fiscal 2024 I assume about $10 billion in free cash flow and from fiscal 2025 going forward, I assume 20% of revenue will be free cash flow (according to management's own targets).

Intel Investor Meeting 2022

However, I assume only growth rates of 5% if management's strategy should not be as successful as planned. This will lead to an intrinsic value of $65.99 for Intel.

Bull Case Scenario

In my bull case scenario, I assume $0 free cash flow in fiscal 2022 and $5 billion in free cash flow in fiscal 2023 and $15 billion in fiscal 2024. From fiscal 2025 going forward I assume once again 20% of revenue will end up as free cash flow, but I will assume growth rates according to management's long-term model and I assume 10% growth from fiscal 2026 till fiscal 2031 followed by 6% growth till perpetuity. This will lead to an intrinsic value of $102.66 for Intel and the stock would be clearly undervalued right now.

Summing Up

The stock appears to be undervalued right now, but we probably must be patient as Intel will most likely report mediocre results for a few more quarters and extremely low free cash flow. And it might take some time before the growth strategy will prove effect and the stock price probably needs some form of catalyst to increase again (for example proof that the growth strategy is effective).

Technical Picture: Strong Support Level

It should also be mentioned that Intel is trading at a strong support level right now. Around $43 we find several lows of the last few years, and so far, that support level held every single time.

TradingView

Conclusion

We should not blindly believe management's claims about double-digit revenue growth in a few years from now when the business was struggling for several years (and achieved only low-single digit revenue growth). However, Intel seems fairly valued right now even when the strategy does not work out and the company can grow only in the low-single digits in the years to come (and I am pretty sure Intel can achieve that).

By purchasing Intel right now, we have a solid investment even if the strategy is not working out. Additionally, we have the option to purchase an extremely undervalued stock if the strategy is working and Intel will grow its revenue in the double digits again. But we might need some patience in the coming quarters before it becomes obvious that Intel's growth strategy is working. And despite a much better performance in the past, I would rather pick Intel instead of NVIDIA or AMD - mostly due to the extremely low valuation, which is making Intel the better investment right now (in my opinion).